At times I was afraid to even check my bank balance account. But now my thinking has just expanded on better ways to spend my money well!

- + 254 (0)746 380 606

- info@mwalimubiashara.com

So, what is your current occupation? Whatever your choice, you’re likely earning a salary or business income – let’s call this income stream 1. Then there is the craze for a side hustle which has caught on in recent years. Well, if you can handle the additional work and remain effective at your regular work station, definitely go for it for the extra buck it promises! – income stream 2. Some are lucky to get to income stream 3.

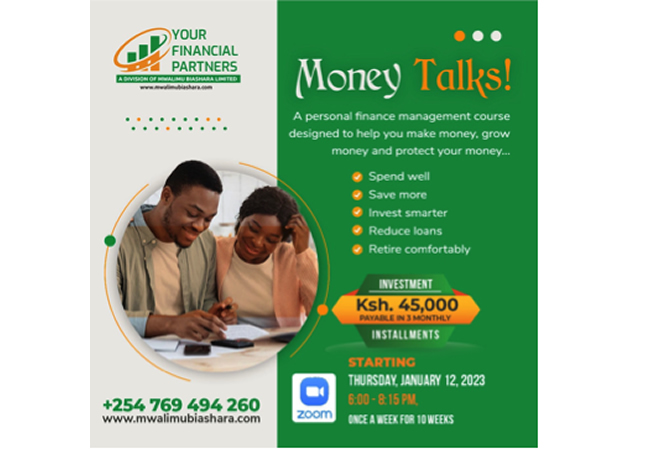

Anyhow, after all the hard work and well-deserved earnings from income stream 1, 2 and 3, how do you apply the money to reach your personal life goals and achieve financial freedom? Our Personal Finance Expert is available to offer practical step-by-step guidelines, tailor-made for you.

Money Talks! series is a program designed to bring a life-time transformation to your personal finances. Click on the module to learn more.

⛔ The first step in any financial plan is establishing your current position.

Our Module 1.1 gives you a clear status of your finances possibly in a way you have not considered before! Whether it is good or bad, establishing your inflows and outflows puts you in full control of your financial life

⛔ How you feel, think and process money is affected by your money story. Most times this story rich and packed with valuable lessons, yet it remains untold.

Our module 1.2 sets the environment for you to safely unpack the patterns that have shaped your financial journey and free you to move forward as the best version of yourself!

⛔ Taking the time to analyze your money can really pay off.

Our Module 1.3 gives you a chance to project your options into the future. It’s like peeling off your financial future so you can walk into it with tranquil, solid assurance. Get an accurate projection of your financial future!

⛔ DEBT! That’s a big one in personal financial management… yet one that is not clearly understood.

Our Module 1.4 is dedicated to demystify debt in a way that helps you take the reins and gain full advantage from debt

⛔ Kidogo kidogo hujaza kibaba!

Our Module 1.5 is packed with nuggets that will shift your perspectives to better saving habits. That feeling of security that you have put aside some money for a rainy day is worth developing the discipline.

⛔ One of the most commonly asked questions in personal financial management is: What is the best investment for me?

Module 1.6 unravels this question with great precision that leaves a smile on your face

⛔ Any time you mention the return you expect from your investment, that is only half the story – the other half is the risk that comes with every investment.

Our Module 1.7 carefully navigates the elements of risk and develops a solid risk management plan to help you anticipate, and mitigate negative impacts of risk on your returns.

⛔ It is said that retirement comes faster than you think… but we say that your sunset days need not come to you like an ambush!

Our Module 1.8 boldly prepares the roadmap to retirement, so you feel secure no matter your age.

⛔ Your personal finances do not operate in a vacuum but are affected by your environment, comprising the political, economic, social, technological and legal settings.

Our Module 1.9 opens up this bigger picture in a way that removes complexity and gives you the confidence to apply the lessons like a pro, and in the most practical way.

⛔ Time to tie it all, neatly, together!

Our Module 1.10 is a celebration that leaves you beaming with confidence to say you are Audacious, Astute and Assured!

At times I was afraid to even check my bank balance account. But now my thinking has just expanded on better ways to spend my money well!

I have moved from just doing budgets (that I don’t even follow☺) to connecting how my spending now is affecting the future of my family.

I am empowered to work with what I have, and explore ways to grow it while living within my means.

The classes were intense and the one-on-one sessions made me cry and panic. I needed to get my act together: budgeting, side hustle, saving, money market. Now am happier.

The class opened my eyes to where my money is disappearing to and my net worth. It brought out the simple yet profound things on money management and flow of my current money management.

I was stuck in debt and I wanted some help to come out; this program has been an eye-opener for me.